Need for CFSS, 2020

An Intro to CFSS, 2020: In the last 2 years, the Ministry of Corporate Affairs (MCA) has strike off many companies and disqualified their directors because of the non-filing of statutory annual returns for a continuous period of three financial years.

As a result, the cost of compliance of these companies is much costlier than normal companies just because of heavy additional fees.

Therefore, the need arrived to come up with a detailed scheme that gives a new chance to make their default good. Accordingly, various stakeholders have requested the MCA for a one-time opportunity to file all requisite belated documents or returns.

Also, the entire world is on lockdown now due to the uncertain situations regarding public health and safety caused by the Coronavirus (COVID-19).

Then, at last, the MCA has come up with a new amnesty scheme called “Companies Fresh Start Scheme, 2020 (popularly called as CFSS, 2020). This scheme provides an opportunity for all defaulting entities to file all the pending ROC forms without additional fees (so-called penalty). The intention is to have a fresh start on a clean slate to make the company active, regularize & fully compliant.

Annual Compliance for Company

All companies incorporated in India are required to file the below every year:

- Audited financial statements

- Audit report

- Board report

- AGM proceedings

- Annual return

- KYC of Directors

- Active Status of the company

The Companies which fail to do so will be liable for

- A penalty of Rs. 200 per day of default or Rs. 10,000 as the case may be

- Non-active status

- Strike off the company

- Deactivation of Director Identification Number (DIN)

- Disqualification of directors

After working with LPC Services, you’ll be able to leave your annual compliance worries behind and get back to focusing on the things that matter most in your life. We offer such services at a very nominal price to encourage startups & innovation in India. To know more about annual compliance’s for a company, click here.

What if The Director is disqualified?

Once the director gets disqualified

- He is not eligible to be a director in his company or any other company

- He has to leave from the position of directorship

- He would not be able to discharge his duties as director once DIN is deactivated

In addition to the above,

- All the board meetings will be invalid if there are only two directors in a company

- All the financial statements signed by them are void

- All the documents, resolutions signed by them are void

Contravention if continued as director after the disqualification

- Fine of Rs. 1,00,000 to Rs. 5,00,000 (or)

- Punishable with imprisonment for a term up to 1 year (or) Both

Validity of CFSS, 2020

The scheme will be effective from 01-April-2020 till 30-Sept-2020. After that, one shall file all the forms as usual with additional fees.

Benefits of CFSS, 2020

It benefits the defaulting company which enables them to file all the pending documents with ROC by condoning the delay. Consequently, this scheme provides

- Immunity from paying additional fees

- Immunity from prosecution or proceedings to be imposed on account of delay with certain filings.

Applicability Of cFSS, 2020

Any defaulting company that has not filed any of the annual compliances mentioned above (or) failed to fulfil any of the ROC compliances, then can make use of this scheme to file belated documents without additional fees.

Non-Applicability OF CFSS, 2020

| SNo | Particulars | Details |

|---|---|---|

| 1 | Vanishing Companies | These are the entities which cease to file their statement of return after raising capital and the registered office is not found or directors are not known |

| 2 | Application for strike off the name has been made | In case by the company itself |

| 3 | Companies against which proceeding for strike off has been initiated & final notice for strike off the name is issued | In case by the ROC initiative |

| 4 | Companies for which application has been made for obtaining dormant status | Not just an inactive company |

| 5 | Companies which been amalgamated or merged | Cannot make any filings |

Forms that can & cannot be filed under this scheme

Almost all the form are allowed to file. Click here for the detailed list of forms available for filing. However, shareholding (SH-7) & charge (CH-1/4/8/9) forms cannot be filled. The below activities can be done by filing SH-7.

- Increase in authorized share capital

- Increase in members of the company

- Consolidation/ division of shares

- Redemption of redeemable preference shares

E-Form CFSS, 2020

The application for obtaining immunity under the CFSS, 2020 has to be made by filing e-form CFSS-2020 within 6 months from the closure of the scheme i.e by 31-March-2020. The SRN of the e-forms filed before 30-Sept-2020 for immunity shall be mentioned in such e-form. Such form has no government fee & at free of cost.

Immunity Certificate

Based on the declaration made in the e-form CFSS-2020, an immunity certificate shall be issued by the designated authority. After granting such certificate, the designated authority may withdraw the prosecutions pending before courts & adjudication of penalties if any, without further action by Ministry of Corporate Affairs (MCA).

Maintaining Compliance

Once regularization of pending compliances made under this scheme, the company is supposed to maintain active compliances in future. LPC Services provides you with the support of compliance management at a very reasonable price. However, if the company has no intention to continue then it can file for dormant status (or) file for strike-off the company.

Hope Served as a Guide on Company Fresh Start Scheme, 2020.

Thank You!!

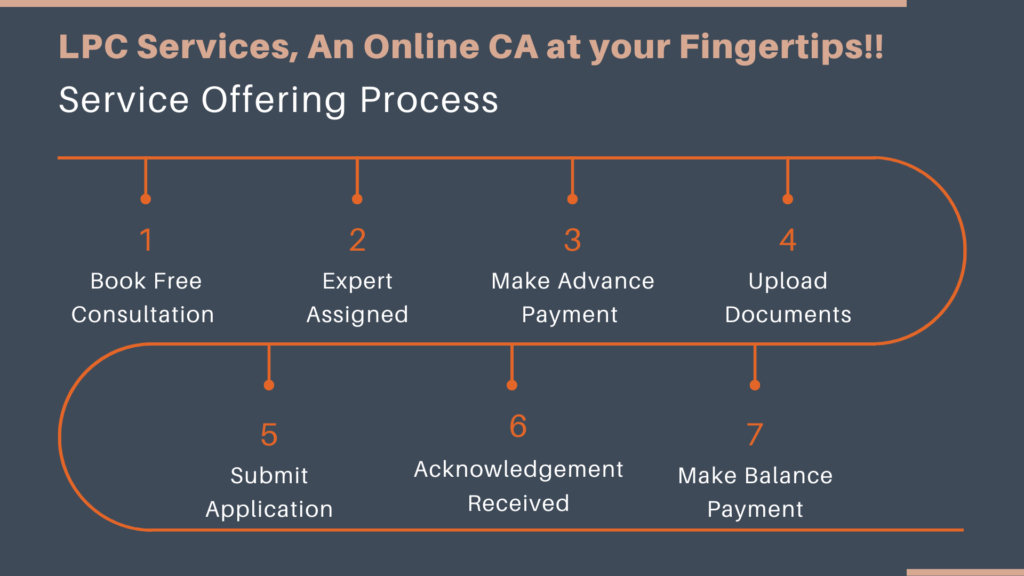

Service Offering Process at LPC Services

“SHARE THIS POST ON SOCIAL MEDIA”

CFSS, 2020