Introduction

Why Is It

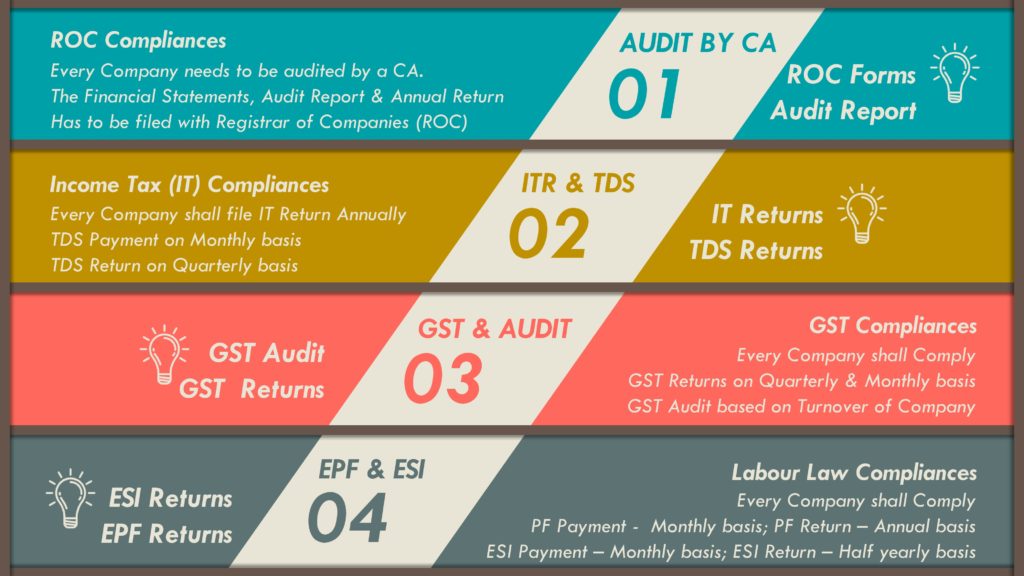

Almost 95% of companies formed in India are private limited companies. Hence, private limited companies are the core base of Indian companies. This resulted in need of ‘Detailed To-do-List of Annual Compliances (Legal, Tax & HR)’ which is required to be followed to get rid of the violation. Such a violation may lead to

- Penalties on per day basis or fixed amount,

- Discharge of company liabilities out of personal assets of directors

- Prosecution or imprisonment depending on the intensity of violation.

The non-filing of financial statements or annual returns for a continuous period of 3 years will result in disqualification of directors and/or strike off the company. Hence the government took an initiative to

- Strike off more than 2,00,000 companies &

- Disqualified more than 3,00,000 directors

Hence it is important to fulfil all the compliance procedures for the peaceful existence of company & for the protection of interest of various stakeholders such as suppliers, customers, shareholders, intermediaries, Bankers, Government, etc.

Annual Compliances

First Year of Company

(1) Convene First Board Meeting (BM)

- Conduct first BM – within 30 days of the formation of the company

- Agenda of the meeting

- Submission of declaration of non-disqualification of each director as he is qualified to act as director in the company

- Disclosure of interest (shareholding) of each director in other entities

- Appointment of auditor by the board of directors (BOD).

(2) Issue Share Certificate

- Issue of share certificate to all shareholders to the extent of the amount of capital invested into the company.

- Such share certificate should be in ‘Form SH-1’ and shall be issued within 60 days of the formation of the company.

(3) Subsequent Board Meetings (BM)

- There shall be a minimum 4 BM’s in a financial year including first BM.

- The gap between two consecutive BM’s must be less than 120 days. Hence directors shall plan accordingly.

(4) Declaration of commencement of business

- The Form ‘INC-20A’ has to be filed with Registrar of Companies (ROC) as a declaration about whether business started or not.

- Such form has to be filed within 180 days of the formation of the company.

(5) Outstanding pending liability to MSME for more than 45 days

- This is applicable in case of the existence of transactions with MSME suppliers/ creditors and whose outstanding pending liability to MSME is more than for a period of 45 days.

- Hence non-payment within 45 days to MSME entities attracts applicability of filing ‘MSME Form I’ with the ROC.

- Time limits for filing

- Initial Return – To be filed as & when applicable

- Half Yearly Return – Subsequent to the applicability

- April to Sept – 31st October

- Oct to Mar – 30th April

(6) Director KYC Verification

- The KYC verification of director to be made by filing ‘Form DIR-3 (KYC)’ with ROC.

- Such form to be filed every year within 30 days from the end of the financial year (FY) [before 30th April]

(7) Financial Statements & Audit Report

- The financial statements including balance sheet, statement of profit & loss, cash flow statement, statement of equity changes shall need to be prepared & duly signed by directors.

- Such financial statements shall also be signed by a practising Chartered Accountant (CA).

- Such CA shall issue Audit Report as to express an opinion on the company which will matter a lot to the stakeholders including bankers for seeking a loan.

(8) Convene Annual General Meeting (AGM)

- Notice shall be sent to all shareholders as a call to appear at AGM

- Agenda of the meeting

- Declaration of dividend (withdrawal of profits for completed FY)

- Presentation of Financial Statements (FS) for discussion

- Discussion of the Board Report & Audit Report

- Re-appointment of existing directors (or) appointment of new directors

- Appointment of auditors by shareholders for a term of continuous 5 years and fixation of their remuneration (Form ADT-1 to be filed mandatorily within 30 days of AGM)

- Any other decisions by the shareholders

(9) Filing Form AOC-4 with ROC

- The AOC-4 is a form with which the Financial Statements & Audit Report of the company are filed with the ROC

- It is to be filed within 30 days of conducting AGM

- Attachments/ Enclosures

- Notice of Call for AGM

- AGM Proceedings/ Resolutions

- Signed Financial Statements

- Independent Audit Report

- Signed Board Report referring to the performance of the company

(10) Filing MGT-7 with ROC

- The Form MGT-7 is an annual return which is to be filed within 60 days of conducting AGM

- This form contains the details about

- Changes in directors such as the appointment of new directors or resignation/ removal of directors during the year

- Changes in a shareholding pattern such as shares – newly issued/ transferred/ sold during the year. This needs to be attached as an enclosure to Annual Return.

- Name board containing name of the company, CIN No & address to be kept outside every office.

- Letterhead, Invoices & any other legal document of the company (e.g. drafting a letter to an official authority) shall contain the name of the company, CIN No, registered office address, phone number, and email address. The same documents shall be used for board reports & resolutions.

- Every company shall have at least one resident director. It means at least one director shall stay in India for a period of atleast182 days. Such 182 days shall be proportionately reduced in the ratio of the number of days available after the formation of the company.

- The company shall keep & maintain the registers as prescribed by many governing laws. Few among them including an index of registers are as follows:

- MGT-1: Register of Members

- SH-06: Register of transfer & transmission of shares

- CHS-7: Register of charge

- Register of Directors & Key Managerial Persons (KMP) & transactions with them

- Register of Share transfers

- Purchase Register

- Sales Register

- Expenses Register

- All statutory records relating to ROC/ GST/ IT/ TDS/ EPF/ ESI Return.

(1) Filing Income Tax Return

- An Income Tax Return (ITR) to be filed every year on or before 30th Sept of next Financial Year (FY).

- Such IT Return shall be filed with the Income Tax Department online in ‘Form ITR-6’

(2) TDS Payment

- Every company shall deduct TDS while making payment to any person based on the rates specified every year.

- Such deducted TDS shall be deposited with Govt on or before 07th of next month

(3) TDS Return

- Every company shall file TDS Return on a quarterly basis in Form-24Q for salary payments & Form-26Q for other payments in India such as rent, promotional expenses, CA fees, architect fees, other professional charges, commission, etc.

- Due dates for filing TDS return are as follows:

- April to June: 31st Aug

- July to Sept: 31st Oct

- Oct to Dec: 31st Jan

- Jan to Mar: 31st May

(4) Advance Tax Payment

- A company shall pay advance tax if the net income tax payable is more than Rs. 10,000. Otherwise not applicable.

- If the actual tax liability is less than 90% of advance tax paid, then the company shall pay interest at the rate of 1.5% per month or part of the month from the respective due dates.

- Due dates for advance tax payment is as follows:

- 15th June: 15% of ET*

- 15th Sept: 45% of ET*

- 15th Dec: 75% of ET*

- 15th Mar: 100% of ET*

- ET* referred above is estimated tax liability on the estimated income.

(5) Tax Audit Report

- It is applicable when the turnover of the company is more than Rs. 1 Crore. Otherwise not applicable.

- A certificate shall be obtained from a Chartered Accountant (CA) as a Tax Audit Report

- The due date of obtaining the Tax Audit Report is 30th Sept of next financial year.

(1) Outward Supplies

- One shall file GSTR-1 containing outward supplies made by the company. The revenue details regarding the sale of goods or services rendered shall be filed in such return.

- Such a return can be filed on a quarterly basis if the turnover is less than Rs. 1.5 Crores.

(2) Net GST Payable

- The GST charged to customers shall be paid to Govt by way of filing GSTR-3B monthly return.

- Such GST charged to customers shall be netted off with GST paid on inward supplies and the balance amount shall be payable to Govt.

(3) GST Audit

- GST audit is mandatory if the turnover is more than Rs. 5 Crores

- Then annual return & reconciliation shall be filed in Form GSTR-9 & 9C by a Chartered Accountant (CA)

(1) What is PF Contribution?

Every employee who joins any company to whom the EPF scheme is applicable has to mandatorily contribute a certain percentage of his salary. The Contribution made by an employee is pooled up in the form of saving or investment which is given to the employee at the time of his retirement or when he switches his job.

(2) EPF Eligibility Criteria

If a company having a salaried employee with a salary less than Rs.15,000 per month, then it is mandatory for a company to open an EPF account to such employees. However, if an employee earning a salary more than Rs. 15,000 then it is not mandatory but optional.

(3) EPF Contribution Percentage

The employer contribution is calculated as 10% of the total of the following components – (basic wages + dearness allowance + retaining allowance). An equal contribution is paid by the employee also.

Out of the 10% employer’s contribution, 8.33% is directed to the Employees’ Pension Scheme (EPS). However, it is calculated on Rs 15,000. So, for every employee receiving a basic pay equal to Rs 15,000 or more, Rs 1,250 each month is diverted into EPS. However, if the basic pay is less than Rs 15,000 then 8.33% of that full amount is directed into EPS. The balance apart from this 8.33% is retained within the EPF scheme. Upon retirement, the employee receives his entire share plus the share retained to his credit in EPF account balance by the Employer.

(4) PF Payment & Return

- The Provident Fund (PF) amount includes an amount deducted from employee salary plus an equal amount to be contributed in extra by the company out of its own pocket.

- It shall be deposited with Govt on or before the 15th of next month. For more details Click Here.

(5) PF Annual Return

- The annual return shall be filed in Form 3A & Form 6A.

- The due date of filing such return is 25th April of next financial year.

(1) When Applicable?

- The ESI scheme is applicable when 10 or more persons employed in a company and the beneficiaries’ monthly wage does not exceed Rs 21,000. Then such a company is covered under the scheme.

- Once the scheme is applicable then it is applicable forever.

(2) ESI Contribution Rates

- Employee Share: 0.75% (Deducted from salary)

- Employer Share: 3.25% (Out of pocket expenses)

(3) ESI Payment

- Such payment of contribution mentioned above shall be made on or before the 15th of next month

- Such payment is made through ESI Portal Online

(4) ESI Return

- Irrespective of applicability, the ESI return to be filed by a company mandatorily

- The half-yearly returns to be filed online within the following due dates

- April to Sept: On or before 11th Nov

- Oct to March: On or before 11th May

Annual Compliances

Subsequent Years

(1) Min 4 Board Meetings (BM)

- There shall be a minimum of 4 BM’s in a financial year.

- However, the agenda of the first board meeting shall include

- Submission of declaration of non-disqualification of each director as he is qualified to act as director in the company

- Disclosure of interest (shareholding) of each director in other entities

- The gap between two consecutive BM’s must be less than 120 days. Hence directors shall plan accordingly.

(2) Outstanding pending liability to MSME for more than 45 days

- This is applicable in case of the existence of transactions with MSME suppliers/ creditors and whose outstanding pending liability to MSME is more than for a period of 45 days.

- Hence non-payment within 45 days to MSME entities attracts applicability of filing ‘MSME Form I’ with the ROC.

- Time limits for filing

- Initial Return – To be filed as & when applicable

- Half Yearly Return – Subsequent to the applicability

- April to Sept – 31st October

- Oct to Mar – 30th April

(3) Director KYC Verification

- The KYC verification of director to be made by filing ‘Form DIR-3 (KYC)’ with ROC.

- Such form to be filed every year within 30 days from the end of the financial year (FY) [before 30th April]

(4) Financial Statements & Audit Report

- The financial statements including balance sheet, statement of profit & loss, cash flow statement, statement of equity changes shall need to be prepared & duly signed by directors.

- Such financial statements shall also be signed by a practising Chartered Accountant (CA).

- Such CA shall issue Audit Report as to express an opinion on the company which will matter a lot to the stakeholders including bankers for giving loans.

(5) Convene Annual General Meeting (AGM)

- Notice shall be sent to all shareholders as a call to appear at AGM

- Agenda of the meeting

- Declaration of dividend (withdrawal of profits for completed FY)

- Presentation of Financial Statements (FS) for discussion

- Discussion of the Board Report & Audit Report

- Re-appointment of existing directors (or) appointment of new directors

- Re-appointment of another auditor if any.

- Any other decisions by the shareholders

(6) Filing Form AOC-4 with ROC

- The AOC-4 is a form with which the Financial Statements & Audit Report of the company are filed with the ROC

- It is to be filed every year within 30 days of conducting AGM

- Attachments/ Enclosures

- Notice of Call for AGM

- AGM Proceedings/ Resolutions

- Signed Financial Statements

- Independent Audit Report

- Signed Board Report referring to the performance of the company

(7) Filing MGT-7 with ROC

- The Form MGT-7 is an annual return which is to be filed every year within 60 days of conducting AGM

- This form contains the details about

- Changes in directors such as the appointment of new directors or resignation/ removal of directors during the year

- Changes in a shareholding pattern such as shares – newly issued/ transferred/ sold during the year. This needs to be attached as an enclosure to Annual Return.

(8) Intimating Changes

In case of change in objects (main or other objects) of the business (or) change in authorized share capital, then shall file altered Memorandum of Association (MOA) within 30 days of passing resolution. Similarly altered AOA if any shall also to be filed within 30 days

In case of changes in paid-up capital (actual capital invested) the company shall file Form PAS-03

In case of changes in authorized share capital limit (max capital can be invested), the company shall file Form SH-07

In case of changes in the director, the company shall file DIR-12 within 30 days.

The company shall keep & maintain the registers as prescribed by many governing laws. Few among them including an index of registers are as follows:

- MGT-1: Register of Members

- SH-06: Register of transfer & transmission of shares

- CHS-7: Register of charge

- Register of Directors & Key Managerial Persons (KMP) & transactions with them

- Register of Share transfers

- Purchase Register

- Sales Register

- Expenses Register

- All statutory records relating to ROC/ GST/ IT/ TDS/ EPF/ ESI Return.

(1) Filing Income Tax Return

- An Income Tax Return (ITR) to be filed every year on or before 30th Sept of next Financial Year (FY).

- Such IT Return shall be filed with the Income Tax Department online in ‘Form ITR-6’

(2) TDS Payment

- Every company shall deduct TDS while making payment to any person based on the rates specified every year.

- Such deducted TDS shall be deposited with Govt on or before 07th of next month

(3) TDS Return

- Every company shall file TDS Return on a quarterly basis in Form-24Q for salary payments & Form-26Q for other payments in India such as rent, promotional expenses, CA fees, architect fees, other professional charges, commission, etc.

- Due dates for filing TDS return are as follows:

- April to June: 31st Aug

- July to Sept: 31st Oct

- Oct to Dec: 31st Jan

- Jan to Mar: 31st May

(4) Advance Tax Payment

- A company shall pay advance tax if the net income tax payable is more than Rs. 10,000. Otherwise not applicable.

- If the actual tax liability is less than 90% of advance tax paid, then the company shall pay interest at the rate of 1.5% per month or part of the month from the respective due dates.

- Due dates for advance tax payment is as follows:

- 15th June: 15% of ET*

- 15th Sept: 45% of ET*

- 15th Dec: 75% of ET*

- 15th Mar: 100% of ET*

- ET* referred above is estimated tax liability on the estimated income.

(5) Tax Audit Report

- It is applicable when the turnover of the company is more than Rs. 1 Crore. Otherwise not applicable.

- A certificate shall be obtained from a Chartered Accountant (CA) as a Tax Audit Report

- The due date of obtaining the Tax Audit Report is 30th Sept of next financial year.

(1) Outward Supplies

- One shall file GSTR-1 containing outward supplies made by the company. The revenue details regarding the sale of goods or services rendered shall be filed in such return.

- Such a return can be filed on a quarterly basis if the turnover is less than Rs. 1.5 Crores.

(2) Net GST Payable

- The GST charged to customers shall be paid to Govt by way of filing GSTR-3B monthly return.

- Such GST charged to customers shall be netted off with GST paid on inward supplies and the balance amount shall be payable to Govt.

(3) GST Audit

- GST audit is mandatory if the turnover is more than Rs. 5 Crores

- Then annual return & reconciliation shall be filed in Form GSTR-9 & 9C by a Chartered Accountant (CA)

(1) What is PF Contribution?

Every employee who joins any company to whom the EPF scheme is applicable has to mandatorily contribute a certain percentage of his salary. The Contribution made by an employee is pooled up in the form of saving or investment which is given to the employee at the time of his retirement or when he switches his job.

(2) EPF Eligibility Criteria

If a company having a salaried employee with a salary less than Rs.15,000 per month, then it is mandatory for a company to open an EPF account to such employees. However, if an employee earning a salary more than Rs. 15,000 then it is not mandatory but optional.

(3) EPF Contribution Percentage

The employer contribution is calculated as 10% of the total of the following components – (basic wages + dearness allowance + retaining allowance). An equal contribution is paid by the employee also.

Out of the 10% employer’s contribution, 8.33% is directed to the Employees’ Pension Scheme (EPS). However, it is calculated on Rs 15,000. So, for every employee receiving a basic pay equal to Rs 15,000 or more, Rs 1,250 each month is diverted into EPS. However, if the basic pay is less than Rs 15,000 then 8.33% of that full amount is directed into EPS. The balance apart from this 8.33% is retained within the EPF scheme. Upon retirement, the employee receives his entire share plus the share retained to his credit in EPF account balance by the Employer.

(4) PF Payment & Return

- The Provident Fund (PF) amount includes an amount deducted from employee salary plus an equal amount to be contributed in extra by the company out of its own pocket.

- It shall be deposited with Govt on or before the 15th of next month. For more details Click Here.

(5) PF Annual Return

- The annual return shall be filed in Form 3A & Form 6A.

- The due date of filing such return is 25th April of next financial year.

(1) When Applicable?

- The ESI scheme is applicable when 10 or more persons employed in a company and the beneficiaries’ monthly wage does not exceed Rs 21,000. Then such a company is covered under the scheme.

- Once the scheme is applicable then it is applicable forever.

(2) ESI Contribution Rates

- Employee Share: 0.75% (Deducted from salary)

- Employer Share: 3.25% (Out of pocket expenses)

(3) ESI Payment

- Such payment of contribution mentioned above shall be made on or before the 15th of next month

- Such payment is made through ESI Portal Online

(4) ESI Return

- Irrespective of applicability, the ESI return to be filed by a company mandatorily

- The half-yearly returns to be filed online within the following due dates

- April to Sept: On or before 11th Nov

- Oct to March: On or before 11th May

About Us

What We Are

LPC Services Provides Risk-Free Solutions Of Legal, Financial, Income Tax & GST With A Clear Vision To Value, Serve & Support Our Customers!

Meet Your Online CA & Leave Your Legal Compliance Worries Behind & Focus On Things That Matters Most In Your Life!!

Always At Your Service!!!