Basic Understanding

Before getting into annual compliances of LLP, it is important to understand what is an LLP. A Limited Liability Partnership or LLP is a legal entity that combines features of a partnership firm and a company. In LLP, the partners have limited liabilities i.e partners have no obligation to pay off the loans or liabilities of the LLP using their personal assets. Also, the partners are not responsible for other partner’s misconduct or negligence.

An LLP is registered under the Limited Liability Partnership (LLP) Act, 2008.

The applicable financial year period is 1st April to 31st March. The annual compliances of LLP have to be followed by every LLP whether you are running the business or not. In fact, these are to be followed even if the business has been closed down. Hence, the annual compliances of LLP have to be followed every year compulsorily.

The non-filing of financial statements or annual returns for a continuous period of 3 years is a violation and will result in disqualification of partners and/or strike off (remove) the LLP with default. Hence the government took an initiative to

- Strike off more than 2,00,000 companies & LLP’s

- Disqualified more than 3,00,000 directors & partners

- Penalties as may be applicable (Refer next section)

Such a violation of not following compliances may also lead to

- Penalties on per day basis (starts from Rs. 200) or fixed amount,

- Discharge of business liabilities out of personal assets of directors

- Prosecution or imprisonment depending on the intensity of violation.

Hence it is important to fulfil all the compliance procedures for the peaceful existence of LLP & for the protection of interest of various stakeholders such as suppliers, customers, shareholders, intermediaries, Bankers, Government, etc.

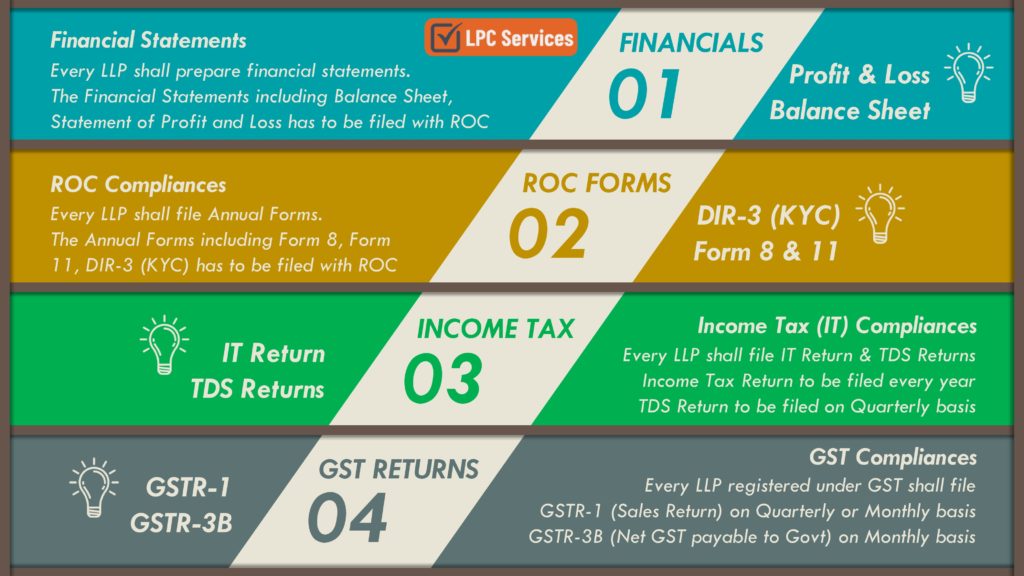

List of Annual Compliances Of LLP

- The LLP Form 8 needs to be filed with Registrar of Companies (ROC).

- It is compulsory for all LLP’s to maintain Accounts & Records. It includes details of the statement of assets and liabilities and statement of profit and loss of the LLP.

- This form needs to be signed by the partners and requires to be certified by a practicing chartered accountant or company secretary or cost accountant.

- This is required to be filed by 30th October of each financial year.

- The Annual Return needs to be filed with the Registrar of Companies (ROC) in LLP Form 11

- This is required to be filed by 30th May of each year.

- DIR 3 KYC is a form to be filed by Every designated partner or director who has been allotted DIN (Director Identification Number).

- It is mandatory for all the designated partners or directors irrespective of their status as approved / disqualified.

- Additionally, DIR-3-KYC-WEB is to be used by the DIN holder who has submitted DIR-3 KYC eform in the previous financial year and no update is required in his details.

- The due date for DIR 3 KYC E form and DIR 3 KYC WEB will be 30th April of next financial year subject to changes if any.

- LLP’s are required to file their income tax return using Form ITR 5 before 31st July every year.

- However, person who are required to get their books of accounts audited as per LLP Act (turnover more than 40 lakhs) [or] as per Income Tax Act, shall need to file their return on or before 30th September every year including partners of the LLP.

- LLP’s are required to file their TDS return on quarterly basis within 30 days from end of quarter.

- However, TDS deducted amount shall be deposited with the Government on monthly basis i.e on or before 7th of next month.

- GST Return need to be filed on monthly or quarterly, as the case may be.

- There are two returns i.e GSTR-1 (Sales Return) & GSTR-3B (Net GST Payable Return)

- If the turnover of the entity is less than 1.5 crores, then one have an option to file GSTR-1 on quarterly basis.

- Irrespective of the case, GSTR-3B need to be filed on monthly basis.

- A composition dealer, need to file CMP-04 on quarterly basis and GSTR-4 on annual basis.

Penalties Applicable

- As per the Limited Liability Partnership Act, 2008 filing of Form 8 and Form 11 is a mandatory requirement for every registered LLP.

- Non-compliance with the LLP annual compliance leads to a penalty (late fee).

- The penalty amount is. 200 per day for each un-filed form.

The penalty (late fees) for non-filing Income Tax returns is as below

- Rs. 5,000, if return filed before 31st December

- Rs. 10,000, if return filed after 31st December

- Rs. 1,000, if the gross total income is less than 2,50,000.

Beside such late fees, one shall not be allowed to close the business (LLP) without filing Income Tax Returns (ITR), at the time of application to the close or strike off the LLP.

(1) Late Fees under Section 234F

- You need to pay Rs 200 per day (two hundred) until your return is filed.

- We need to pay this late fees for every day of delay until the late fee amount is equal to the amount we are supposed to pay as TDS to Government.

(2) Interest

- Non-Deduction of TDS – Interest to be paid at the rate of 1% per month.

- After deduction of tax, for not depositing TDS deducted with Government, interest to be paid at the rate of 1.5% per month.

(3) Penalty on Assessment

- Apart from late fees & interest, penalty amount may charged at the rate of 100% of amount ought to be deducted or remitted in addition to the TDS amount.

(4) Prosecution

- Designated Partner & Partners shall be punishable with rigorous imprisonment for a term which shall not be less than three months but which may extend upto seven years along with the fine.

For zero sales & purchases (nil return): lower of ₹20/day or ₹10,000

For those having sales & purchases (regular return): lower of ₹50/day or ₹10,000

Note: Such late fees to be calculated for every return in a period (GSTR-1, GSTR-3B, etc)

Post-Incorporation Compliances

Apart from the regular annual compliances of LLP, there are also one-time compliances immediately after LLP formation.

It is compulsory for the LLP to execute and file the LLP Agreement within 30 days of the formation with the Ministry of Corporate Affairs (MCA). The Agreement typically covers the responsibilities & duties of each partner.

Penalty: Failure to file the LLP Agreement within 30 days then LLP is liable to be fined at the rate of Rs. 200 per day of default with no upper limit to it.

Action Point:

- File Form-3 enclosing LLP Agreement with ROC by paying requisite MCA fees.

- The LLP is required to apply for the PAN Card and TAN Number.

- One can apply for GST Registration voluntarily.

- Open Current Account in any bank in the name of LLP and deposit the capital amount mentioned in the partnership deed into such bank account.

- Shall make arrangements for LLP seal and LLP letterheads.

Our Support

LPC Services Team is always with you throughout your business life-cycle and will help you to get register an LLP & assist you to follow all the annual compliances of LLP every year.

LPC Services always supports you to fulfill your business requirements as a business coach!

We are always at your service!!