Sections Discussed Below:

- An Intro to GST

- Basic Funda that Businesses Should Know About GST

- Eligibility for GST Registration

- Documents for GST Registration

- HSN/SAC Code of Goods and Services

- Summary of Composition Scheme

- All about GST Returns

- At last, Registration Process Under GST For Regular And Composition Scheme

Frequently Asked Questions (FAQ)

- What is the government fee for GST Registration?

- How to apply GST for new business if you already have a new business?

- What are the benefits of GST registration?

- Decoding GSTIN number: What is GST registration number?

- How to find my GSTIN number easily?

- How to check all the registrations on my PAN?

- How to recover my username – GST logins?

- How to recover my password – GST logins?

I. An Intro of GST:

It is important to know about the basic understanding of GST before insights of GST registration. Goods & Service Tax (GST) is an indirect tax on the supply of goods & services. In simple terms, an indirect tax can be referred to as the ultimate tax burden is on the end customer. GST ensures uniformity in the indirect tax structure replacing the Pre-GST regime taxes such as state levy of sales tax/ VAT, entry tax, purchase tax, etc and central levy of central excise duty, additional excise duty, service tax, CST, countervailing duty.

The taxes paid to the central government (Central Excise, CST, Service Tax) cannot be taken as a credit for taxes payable to the state government (VAT). Now in GST regime, has overcome the limitation by availing credit of IGST paid (Central) for CGST & SGST payable (State).

Hence GST ensures continious chain of credits & thereby reduces the overall cost to the end customer.

II. Basic funda that businesses should know about GST

- As discussed above, GST is a mix of state tax (VAT) & central tax (Excise, Service Tax) in the context of Pre-GST regime.

- GST registration limits – 40 Lakhs/ 20 Lakhs/ 10 Lakhs as the case may be.

- E-way bill registration

- Issue or collect – Tax invoice/ Delivery Challan according to GST rules

- Input Tax Credit – GST paid for your purchases can be taken as credit while calculating net GST payable to the government [Tax on Sale (-) Tax already paid on purchases].

- Documents/ Records required to be maintained under GST laws.

- GST returns – Monthly/ Quarterly/ Annually

- Opting Schemes under GST – which is most beneficial according to pattern how businesses operate.

Above all are discussed in detail in later sections.

III. Eligibility for GST Registration:

Generally, requirement for GST Registration can be classified into

- Mandatory GST Registration

- Voluntarily GST Registration

Mandatory Registration under GST

(1) Based on Turnover or Sales

Apply for GST number, when sales or turnover crosses specified limits such as

- 40 Lakhs – Exclusively engaged in the supply of goods i.e selling only goods but not services

- 20 Lakhs – Supplying Services (or) Goods & Services

- 10 Lakhs – Supplying Goods or Services in Manipur, Mizoram, Tripura, Nagaland.

It is to be noted that Rs. 40 Lakhs limit is not applicable to Telangana & Pondicherry and the applicable limits are 20 Lakhs in such locations.

If your turnover is exceeding above limits then apply for GST online. It is not a compulsion that one needs to register under GST only if turnover is more than the above limits. He can register even if turnover is less than such limits falling under the category of voluntary registration scheme more clearly described in a later section.

(2) Irrespective of Turnover or Sales, shall obtain compulsory GST registration

- Sale of goods between the two different states (interstate) including the branches of the same entity. However, the interstate supply of services is not mandatory.

- Export of goods or services

- Sale of goods through e-commerce operators. So-called Amazon GST registration.

- Supply of services through e-commerce operators.

- Casual taxable person. The temporary GST registration to be obtained when he intends to do business from such a location having no fixed place of business. For instance, a person from Chennai wishes to do business in Delhi on a temporary basis then he needs to obtain such temporary GST registration in Delhi. However, if he supplies from Chennai to his customer located in Delhi then this concept will not apply.

- Non-resident Indian (NRI) or foreign company intends to do business in India shall register under GST with a valid passport

- Person liable to pay GST on Reverse Charge Mechanism (RCM) basis.

- Agent supplies on behalf of the principal. If the principal issues invoice for the supply made by the agent, then this concept will not apply.

Above all, GST number for business is compulsory. So, shall register under GST irrespective of turnover.

Voluntary GST Registration:

Voluntary registration scheme under GST means registering under GST on own notion irrespective of above-referred turnover limits.

Although GST registration is not mandatory for business having turnover below 40 Lakh/ 20 Lakh/ 10 Lakh, few organizations are demanding GST registration details to fulfil their own requirements which make businesses hassle. Few among them are as follows:

- Opening the current account in any bank

- Obtaining business loans from banks & financial institutions above certain limits

- A person providing services online through an e-commerce platform. For example, a restaurant registering in Swiggy/ Zomato are imposed to register under GST even though not required as per the law if the turnover of the restaurant is below 20 Lakh/ 10 Lakh.

- Apply for government projects

- Business with government

- Business with corporate customers. And the list keeps growing…

Nevertheless, GST registration aids to ease of doing business in India.

IV. Documents for GST Registration:

| Nature of the entity | Documents Required |

|---|---|

| Sole Proprietor / Individual | 1. PAN number 2. Aadhaar number 3. Bank account details [Personal A/c No, IFSC]. Once the current account is obtained shall need to update the bank details in GST portal 4. Photograph (JPEG format, max size 100 kb) 5. Address Proof: (Ref Note:1) – Rental agreement – NOC from owner – Proof of address |

| Partnership Firm/ LLP | 1. PAN card of the firm & all its partners 2. Aadhaar card of all partners 3. Partnership deed 4. Registration certificate of LLP 5. Photograph of all partners (JPEG format, max size 100 kb) 6. Bank account details (Ref Note:2) 7. Address Proof: (Ref Note:1) – Rental agreement – NOC from owner – Proof of address 8. Authorized signatory declaration [Ref Note: 3] If an authorized signatory is not a partner or any employee, then a photograph, PAN & Aadhaar are also required. 9. Digital Signature Certificate (DSC) of authorised signatory [In case of LLP] |

| 1. PAN card of company & all its directors 2. Aadhaar card of all directors 3. Certificate of Incorporation (COI) 4. Photograph of all directors (JPEG format, max size 100 kb) 5. Bank account details (Ref Note:2) 6. Address Proof: (Ref Note:1) – Rental agreement – NOC from owner – Proof of address 7. Authorized signatory declaration [Ref Note: 3] If an authorized signatory is not a director or an employee, then a photograph, PAN & Aadhaar are also required. 8. Digital Signature Certificate (DSC) of authorised signatory |

Note: 1 Address Proof

- The rental agreement is not required if the property is owned by you or your parents where you don’t pay any rent. In such cases, just NOC along with one proof of address is enough.

- Any one proof of address to be uploaded – electricity bill, telephone bill, property tax, property document (for the owner)

- NOC is required in all cases.

Note: 2 Bank account details (JPEG or PDF, Max size 100kb)

- Copy of cancelled cheque or

- Frontpage of passbook or

- Bank statement containing account number & IFSC code

Note: 3 Proof of appointment of the authorized signatory to be attached. You can take advantage of our formats. Click Here to access the files below.

- Letter of Authorization (or)

- Copy of Board Resolution

V. HSN/SAC Code of Goods & Services

The list of goods & services that you are going to supply needs to be provided for GST registration. However, you may need a CA/ GST consultant like LPC Services to select right HSN/ SAC code for the goods & services.

VI. Summary of Composition Scheme

The composition dealer shall not collect GST from the customer. Instead, he shall pay the GST out of his own pocket at the concessional rate as mentioned below.

(1) A summary of the composition scheme tabulated as below:

| Particulars | Supplying Goods | Supplying Services |

|---|---|---|

| Composition Scheme Name | Regular Composition Scheme | Composition Scheme under Notification no. 02/2019 |

| Rate of GST | 1% on the turnover during the period | 6% on the turnover during the period |

| When applicable? | Previous year turnover upto Rs. 1.5 Crore (Rs. 75 Lakh for northeastern states) | Previous year turnover upto Rs. 50 Lakh |

| To whom applicable? | Manufacturer & trader engaged in the supply of a. Goods only b. Goods & Services | Manufacturer, trader & any service provider supplying a. Services only b. Goods & Services, where the value of services exceeding below limits |

| To whom not applicable? (Common points discussed later) | Exclusive Service Provider except for the restaurant business | Exclusive Seller of goods |

| Restriction on the supply of services | Value of supply of services shall not exceed higher of below limits a. Rs. 5,00,000 b. 10% of previous year turnover | Value of services shall not exceed Rs. 50 Lakh |

| Who cannot opt for composition scheme? | Manufacturer of notified goods | Both manufacturer & trader of notified goods |

Note: The notified goods referred above includes

- Ice cream

- Edible Ice

- Tobacco & Tobacco products

- Pan masala

(2) Who Cannot opt for composition scheme?

- Exempted Goods & Services

- Sale of goods between two different states

- Goods sold through electronic commerce operators eg: Amazon, Flipkart, Paytm.

- Supply of services through electronic commerce operators as specified under sec 9(4). [Transportaion of passengers, accommodation in hotels, housekeeping services]

- A manufacturer of notified goods such as ice cream, edible ice, pan masala, tobacco & tobacco products

- Casual taxable person

- Non-Resident Foreign Taxpayer

- A person registered as TDS Deductor /Tax Collector.

VII. All about GST returns

A. Regular Scheme

(i) periodical Returns

- GSTR-1: Monthly/quarterly return: As mentioned in the below section, information about the supply of goods or services is required for filing GSTR-1 on or before 11th of next month/quarter. The businesses whose turnover is more than 1.5 Crore shall mandatorily require to file the returns on a monthly basis. In other words, others may opt for quarterly returns.

- GSTR-3B: Monthly return: Payment of net GST payable (Tax on sale less Tax on purchases) to the government on or before 20th day of next month.

Information required for filing such returns – B2B & B2C:

For Business to Business (B2B) Sales (or) Purchases for claiming input credit:

- Supplier Name

- GSTIN of Supplier

- Invoice Date

- Invoice Number

- Gross amount before GST

- GST rate

- Amount of IGST, CGST, SGST charged

- Invoice Value (Bill amount after-tax)

For Business to Customers (B2C) Sales: (Popularly called retail sale)

Summary of total sales – GST rate wise classification is required for filing GSTR-1 & GSTR-3B returns

| GST Rate | Gross Value | IGST | CGST | SGST | Invoice Value |

|---|---|---|---|---|---|

| Nil Rate | |||||

| 5% | |||||

| 12% | |||||

| 18% | |||||

| 28% |

(iI) Annual Returns

- GSTR-9: Annual return to be filed every year if the turnover of that particular year is more than Rs. 2 Crores.

- GSTR-9C: Reconciliation Statement to be filed every year if the turnover of that particular year is more than Rs. 2 Crores.

B. Composition Scheme

(i) Periodical Returns

Form GST CMP 08 (earlier called GSTR-4): Quarterly returns to be filed on or before 18th day of next quarter. The GST as a percentage of sales, payable to the government.

(iI) Annual Returns

Not mandatory to file i.e optional GST returns – GSTR-9A, GSTR-9C

Conversion from regular to composition scheme (or) from composition scheme to regular scheme:

- Form GST CMP 02: To be filed once in a year, intimating willingness to opt composition scheme for next financial year atleast before end of the current financial year. For instance, select option before 31-Mar-2020 for FY 2021-22.

- A person under regular scheme willing to opt for composition scheme by filing form GST CMP 02, shall need to file form GST ITC 03 to reverse Input Tax Credit (ITC) on the opening stock of the financial year atleast before 60 days from the commencement of the relevant financial year. In other words, atleast before 31-Jan-2020 (Approx) for FY 2020-21.

- Similarly, a person under composition scheme willing to opt for the regular scheme shall need to file form GST ITC 01 to avail Input Tax Credit (ITC) on the opening stock of the financial year atleast before 30 days from the commencement of the relevant financial year. In other words, atleast before 01-Mar-2020 (Approx) for FY 2020-21.

Frequently Asked Questions (FAQ)

1. What is the government fee for GST registration?

There is no GST registration fee payable to government. Hence a GST registration online is free.

2. How to apply GST for new business if you already have a GST registered business?

If you have multiple GST registrations in same state or having GSTIN registration number in different states, still you can again apply for GST number on the same PAN and the monthly returns of all such GSTIN registrations shall be filed on time to avoid late fees popularly known as penalty. In fact it is not levied in the nature of penalty but as a compensatory late fee.

3. What are the benefits of GST registration?

- Sell goods & services anywhere in India.

- Selling goods online through e-commerce platforms such as Amazon, Flipkart, Paytm Mall. However, selling on the Facebook market place has no compulsory requirement for GST registration.

- Can have business with corporate customers

- Can do business with government agencies

- Can apply for government projects

- Can apply for tenders/bids

- Can increase trust between the customers since you issue valid tax invoice & your registration is approved or certified by the government

- Can be stronger than unregistered business since you are recognized as an authentic registered business in your society.

- Can take credit of GST paid on purchases (Input Tax Credit). However, an unregistered business should bear that cost.

- Can get loans from banks & financial institutions. The GST registration certificate acts as valid proof of your business to increase the chances of getting a loan.

4. Decoding GSTIN Number: What is GST Registration Number?

Goods & Service Tax Identification Number (GSTIN) is issued by GST Department upon registration under GST. It comprises of 15 digits. The first two digits represent state code, next ten digits represent PAN number, next one digit represent entity code such as sole proprietor, partnership firm, LLP, company, trust, society, associations, government or local authority, etc and the last but one digit is blank & last digit is used as a check digit.

5. How to find my GSTIN Number easily?

If your are registered under GST but forgot your GST number then find your GSTIN number by following steps

- Step: 1 Go to official GST portal https://www.gst.gov.in/

- Step: 2 Click on to “Search Taxpayer” & “Search by PAN”

- Step: 3 Enter your PAN number & click on search

6. How to check how many registrations made for a PAN?

All the GSTIN numbers of a person can be identified based on the PAN whether or not a person has more than one GST registration by the following procedure.

- Step: 1 Go to official GST portal https://www.gst.gov.in/

- Step: 2 Click on to “Search Taxpayer” & “Search by PAN”

- Step: 3 Enter your PAN number & click on search

7. How to recover my username – GST Logins?

If you have forgot username then change your username and password in the following manner.

- Step: 1 Go to official GST portal https://www.gst.gov.in/

- Step: 2 Click on to login

- Step: 3 Click on forget username

- Step: 4 Enter the GSTIN number & generate OTP

- Step: 5 Enter the OTP sent to the mobile number (OR) e-mail address provided at the time of GST registration & click on to submit

- Step: 6 Create new username & similarly create new password

8. How to recover my password – GST Logins?

If you have forgot password then change your password in the following manner.

- Step: 1 Go to official GST portal https://www.gst.gov.in/

- Step: 2 Click on to login

- Step: 3 Click on forget password

- Step: 4 Enter the username & generate OTP

- Step: 5 Enter the OTP sent to the mobile number (OR) e-mail address provided at the time of GST registration & click on to submit

- Step: 6 Create a new password

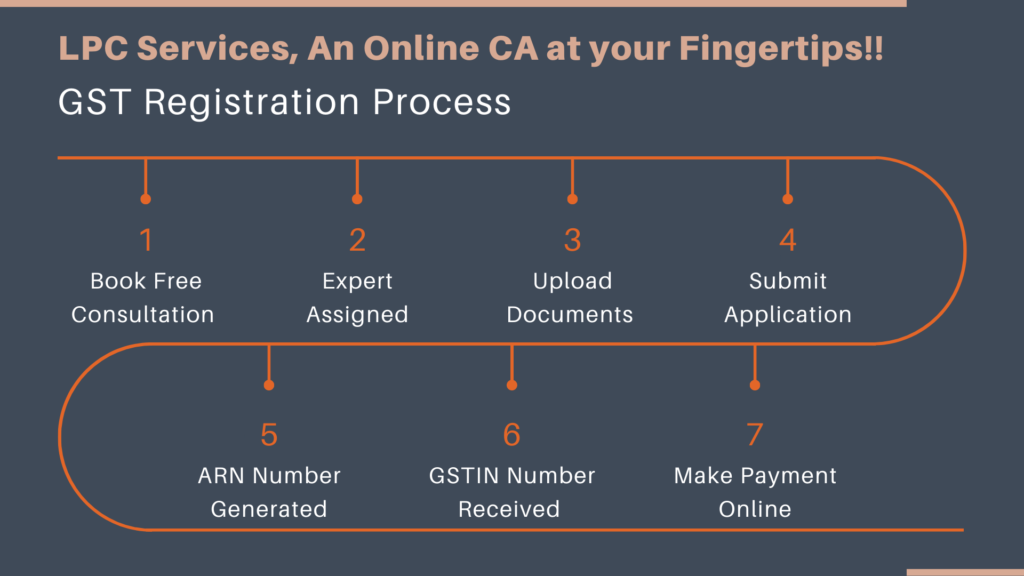

Registration Process Under GST For Regular And Composition Scheme

- First of all, just log in on GST official Portal.

- Fill up the Part A of GST Registration Form-1 by the Professional.

- You will get received the reference number via email and mobile number.

- Fill Up the second part of the registration form and upload the below documents as per the business entity.

- Finally, a Certificate of Registration has been issued by the Government of India once your application is approved.

Nevertheless, you may need a professional like CA/ GST Consultant to select the right AO code & proper HSC code for GST registration with proper documents. So, it is always preferable to take services from a CA/ GST Consultant like LPC Services which helps you to get GST registration without any rejection.